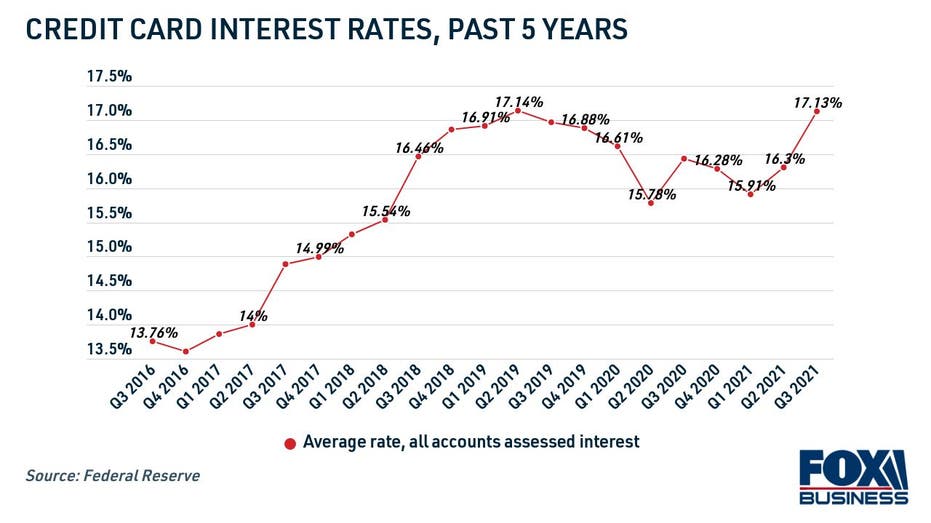

Credit card interest rates hit a near-record high in Q3, reaching 17.13%. Consider these methods for paying off high-interest credit card debt. (iStock).

Credit cards are a flexible, widely accepted payment option allowing consumers to spread out large payments over time. But credit card interest rates have been rising steadily and recently surpassed 17% for only the second time ever, per Federal Reserve data.

The average rate on all credit card accounts assessed interest was 17.13% in Q3 2021. That’s up from 16.3% in Q2 and 15.91% at the beginning of the year. The only other time credit card rates have been this high was in 2019, when interest rates spiked to 17.14%.

BORROWERS WHO CONSOLIDATED CREDIT CARD DEBT SAVED $2K+ ON AVERAGE, DATA SHOWS

Rapidly rising credit card rates — coupled with a 10.9% increase in revolving debt balances in the second quarter of this year, according to the Fed — can spell disaster for consumers who have trouble making consistent monthly payments on their credit balances.

Carrying high-interest revolving credit card debt from month to month can cost you hundreds or thousands of dollars in interest payments over time. Thankfully, there are a few ways to pay off credit card debt faster and save money in the long run

3 proven methods for credit card consolidation

Since credit cards have some of the highest interest rates on the market, making the minimum payment every month isn’t a very efficient method of debt repayment. In fact, it could cost you thousands of dollars in compounded interest over time, depending on your account balance and interest rate.

ere are three common ways you can pay off credit card debt faster:

- Personal loans

- Balance transfers

- Cash-out refi

Consider each option in the sections below, keeping in mind your unique financial situation.

DEBT SNOWBALL METHOD VS. DEBT AVALANCHE METHOD

1. Personal loans

Personal loans offer fast, lump-sum funding that you repay in fixed monthly payments over a set period of time, typically a few years. Since personal loans have a consistent repayment schedule and lower interest rates, they’re commonly used to consolidate high-interest credit card debt.

Unsecured personal loans don’t require collateral, which means that eligibility and interest rates rely heavily on your credit history and debt-to-income ratio. Applicants with good credit will receive the most favorable loan offers with lower interest rates, while those with bad credit should build their credit score before applying.

Raising your credit score could be as simple as checking your credit report for errors, or opening a secured credit card to increase your available credit and lower your credit utilization ratio.

When you’re ready to apply for a debt consolidation loan, be sure to compare rates on Credible so you can know you’re getting the best deal in the long term.

2. Balance transfer credit cards

It may seem counterintuitive to take out another credit card to pay off your debt, but you may be able to save on interest charges during the debt payoff process with a balance transfer.

The key is to find a credit card issuer that offers a 0% APR introductory period — typically up to 18 months. Once you do, conduct a credit card balance transfer to move your debt from your current account to a new credit card. Then be sure to repay your debt in full before the promotional period expires.

There are a few things to keep in mind when utilizing a balance transfer:

- You may have to pay a balance transfer fee worth about 3-5% of the total amount of debt being transferred.

- You’ll need good credit to qualify for a balance transfer card. Keep making on-time payments to ensure your credit score doesn’t take a hit before you apply.

- Avoid taking out any new debt during this time so you don’t end up falling into bad habits by racking up more credit card debt than you can pay off.

3. Cash-out mortgage refinancing

Home values are at an all-time high, which means you could be sitting on tens of thousands of dollars worth of untapped equity. One way to pay off your credit card accounts at a lower interest rate is to access that equity through cash-out refinancing

Cash-out mortgage refinancing is when you take out a larger mortgage than what you currently owe on your home loan, pocketing the difference in a lump sum of cash to use as you see fit. Since mortgage rates are still hovering near all-time lows, according to Freddie Mac, now may be a good time to refinance your mortgage.

Keep in mind that cash-out mortgage refi will likely raise your monthly payments since you’re taking out a larger home loan.